Get the free ssa 766

Show details

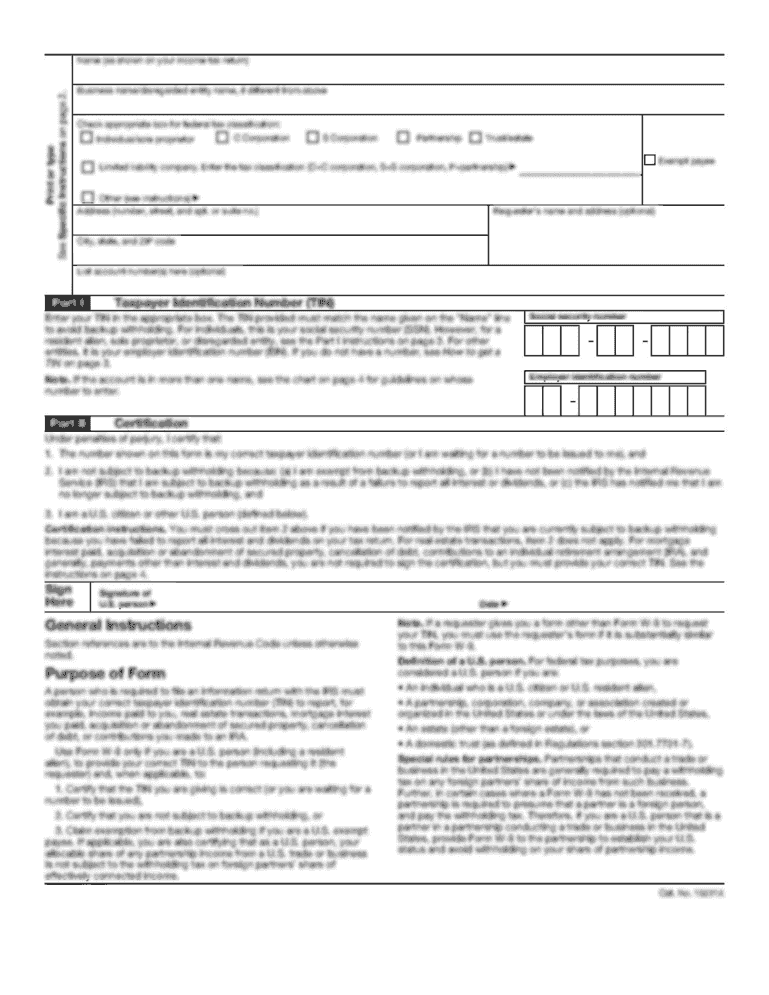

This form is used by the Social Security Administration to determine self-employment income for the current taxable year, which may affect eligibility for Social Security benefits.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ssa 766 form

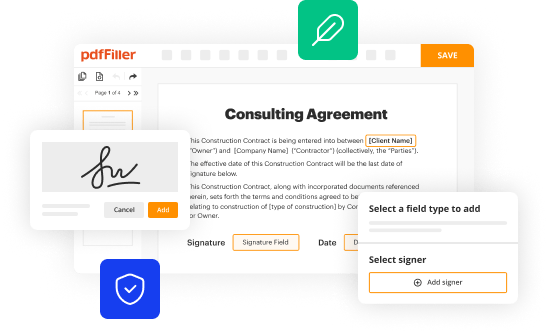

Edit your ssa 766 form form online

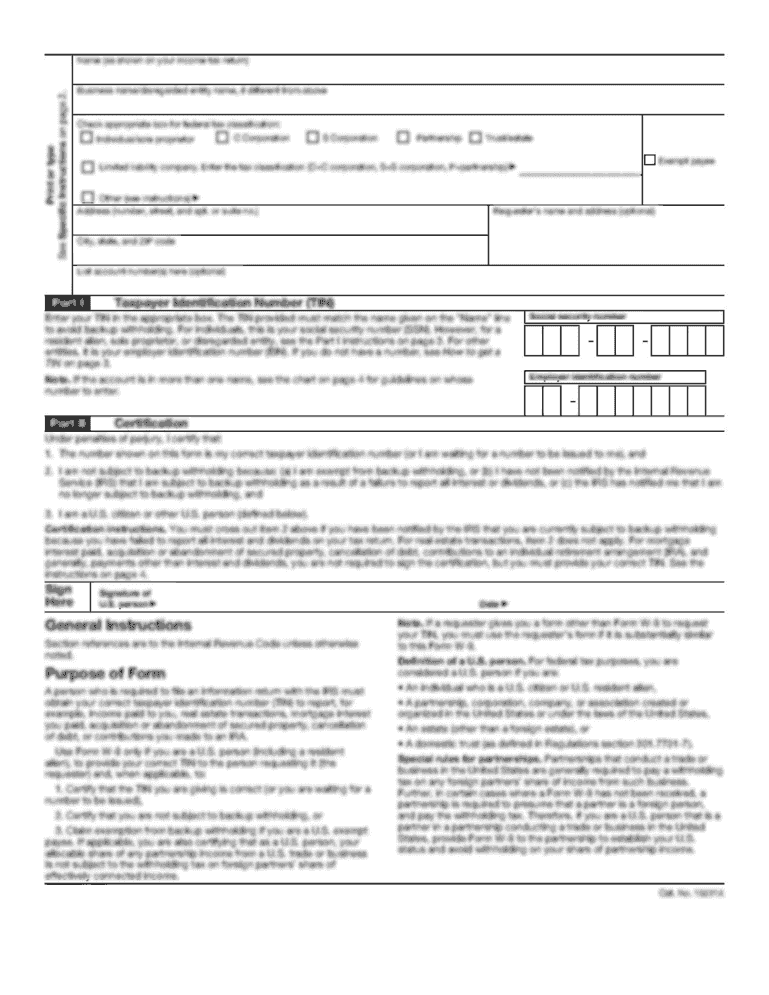

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

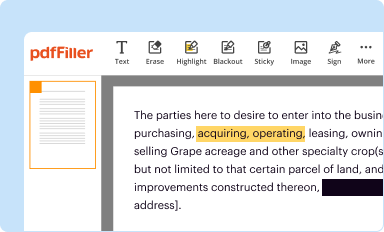

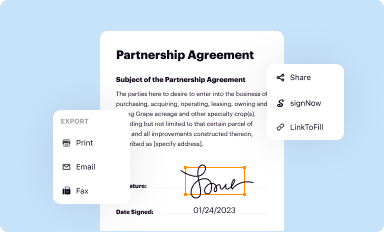

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ssa 766 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ssa 766 form online

Use the instructions below to start using our professional PDF editor:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit ssa 766 form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ssa 766 form

How to fill out SSA 766:

01

Obtain the SSA 766 form from either the Social Security Administration's website or your local Social Security office.

02

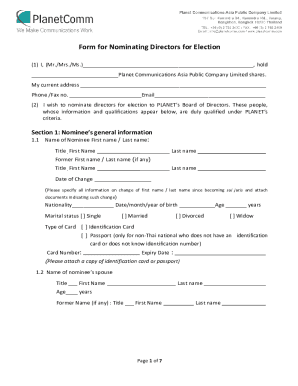

Begin by providing your personal information, including your name, Social Security number, and contact information.

03

Identify the reason for completing the form, such as if you are seeking disability benefits or requesting a review of a previous decision.

04

Indicate whether you have a representative assisting you with your claim, and provide their contact information if applicable.

05

Next, carefully read and answer each question on the form accurately and to the best of your knowledge.

06

If necessary, provide additional information or attach any supporting documents that may help establish your claim.

07

Once you have completed the form, review it for any errors or missing information before signing and dating it.

08

Make copies of the completed form and any accompanying documents for your records.

09

Submit the original form and copies to your local Social Security office either in person, by mail, or by using their online submission portal.

Who needs SSA 766:

01

Individuals who are applying for or requesting a review of disability benefits from the Social Security Administration may need to fill out SSA 766.

02

This form may also be required for those seeking to provide additional information or evidence related to their disability claim.

03

Individuals who have a representative assisting them with their disability claim may also need to complete this form.

04

It is important to consult with a Social Security representative or a legal professional to determine if you specifically need to fill out SSA 766 in your circumstance.

Fill

form

: Try Risk Free

People Also Ask about

How to fill out a Social Security application form?

0:30 1:54 How to Fill Out a Social Security SS-5 Form - YouTube YouTube Start of suggested clip End of suggested clip If you are applying on behalf of a dependent. Child fill out the parental. Information such as theMoreIf you are applying on behalf of a dependent. Child fill out the parental. Information such as the full names and social security. Numbers if you are applying for a replacement.

How to calculate Social Security wages?

To calculate an employee's Social Security wages, take the employee's gross pay amount and subtract any exclusions such as reimbursed travel expenses and HSA contributions (see exclusions listed above).

Does the IRS report self-employment income to Social Security?

Their employer deducts Social Security taxes from their paycheck, matches that contribution, sends taxes to the Internal Revenue Service (IRS), and reports wages to Social Security. However, self-employed people must report their earnings and pay their Social Security taxes directly to the IRS.

How do I report self-employment income to Social Security?

How do I report earnings? You may call us at 1-800-772-1213. Or you may call, visit, or write your local Social Security office. Social Security also offers a toll-free automated wage reporting telephone system and a mobile wage reporting application.

What is SSA 766?

Form SSA-766 Statement of Self-Employment Income.

How do you show income if self-employed?

Some ways to prove self-employment income include: Annual Tax Return (Form 1040) This is the most credible and straightforward way to demonstrate your income over the last year since it's an official legal document recognized by the IRS. 1099 Forms. Bank Statements. Profit/Loss Statements. Self-Employed Pay Stubs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get ssa 766 form?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific ssa 766 form and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I complete ssa 766 form online?

Completing and signing ssa 766 form online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

Can I sign the ssa 766 form electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your ssa 766 form in seconds.

What is ssa 766?

SSA 766 is a form used by the Social Security Administration (SSA) to gather information required to determine the validity of a claim for a Social Security benefit, specifically in relation to an individual's work history and earnings.

Who is required to file ssa 766?

Individuals who are applying for Social Security benefits and need to provide information about their work history or who are involved in a dispute regarding their work status are required to file SSA 766.

How to fill out ssa 766?

To fill out SSA 766, follow the instructions provided with the form carefully, ensure all personal information is accurate, include relevant work history details, and submit the completed form to the SSA either online or by mail.

What is the purpose of ssa 766?

The purpose of SSA 766 is to assist the SSA in evaluating claims for Social Security benefits by collecting necessary details about an individual's earnings and employment history.

What information must be reported on ssa 766?

SSA 766 must include information such as the individual's name, Social Security number, details of past employment, dates of employment, and any disputes regarding earnings or work status.

Fill out your ssa 766 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ssa 766 Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.